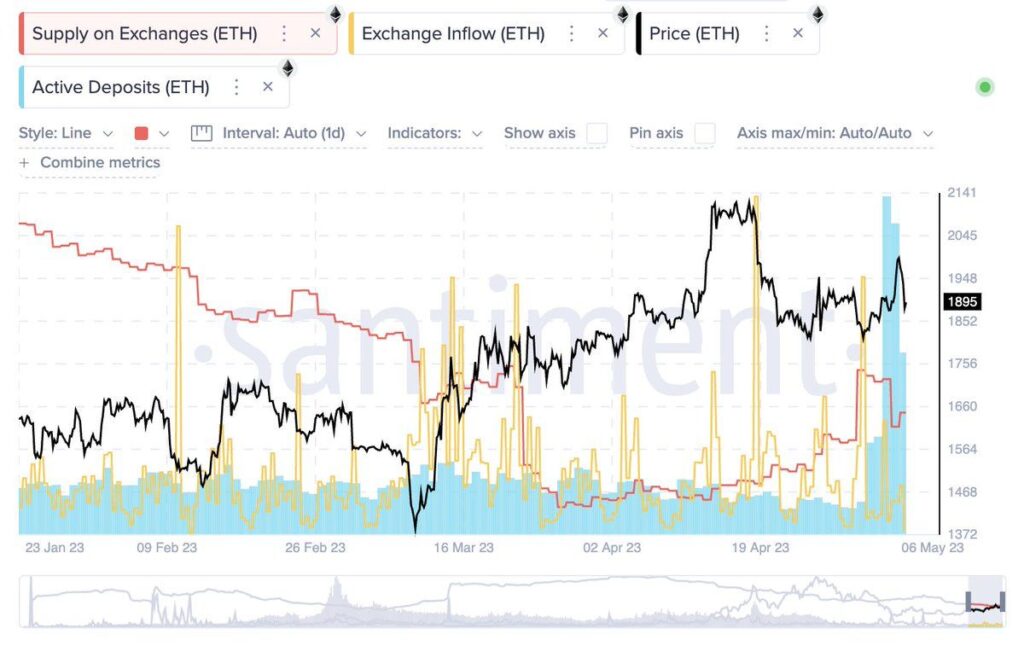

Ethereum, the second-largest asset by market capitalization, is currently under intense selling pressure with the increase in ETH inflow to centralized exchanges. Typically, a rise in ETH inflow is associated with increased selling and a negative impact on the asset’s price.

Based on on-chain data from crypto intelligence tracker Santiment, there is a massive spike in Ethereum deposits to centralized cryptocurrency exchanges which signals an increase in short-term selling pressure on the asset.

We consider the $1,933 a key level for Ethereum. However, we also believe that the altcoin needs to show strength to begin its recovery.

The altcoin’s price recently declined to the $1,800 level, with the increased supply on exchanges and distribution by the Ethereum Foundation and market makers. It remains to be seen whether ETH will recover from the recent pullback in its price.

As seen in the chart above, the supply of Ether climbed to 12.87 million on May 6, from 12.53 million on April 19, 2023. In the same timeframe, the ETH price declined from the $2,000 level to $1,895.