KEY POINTS

Lending platforms that use non-fungible tokens (NFTs) as underlying assets have seen significant volumes in transactions.

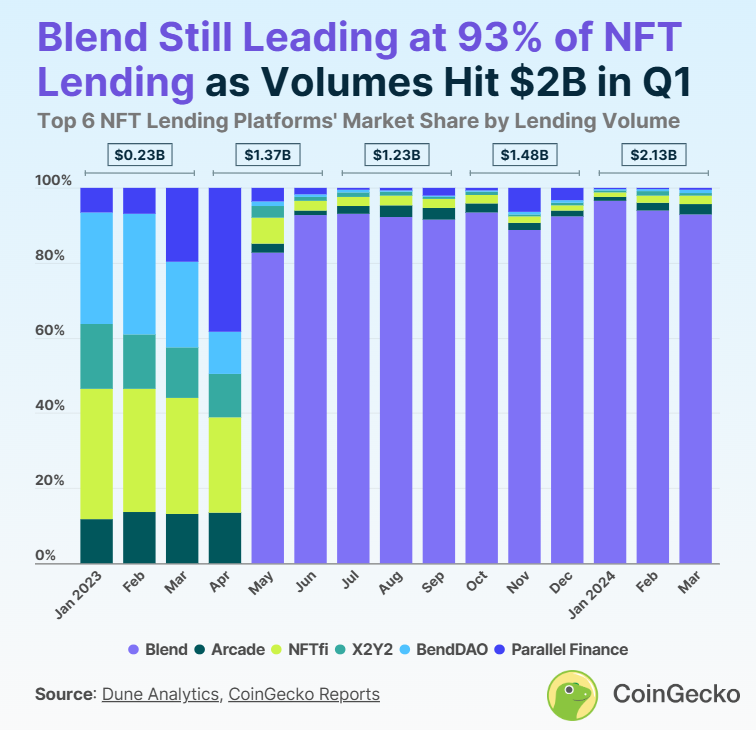

According to a CoinGeko report, NFT lending volume in the first quarter of 2024 was an impressive $2.13 billion, representing a 43.6% increase over the previous quarter.

January 2024 recorded the highest $0.90 billion in monthly lending volume, surpassing the previous high of $0.85 billion in June 2023.

The report is based on Dune Analytics data of top NFT lending platforms’ lending volume from January 2023 to March 2024.

Blend, the NFT lending platform of the Blur NFT marketplace, leads the tally with 92.91% of the market share. Its monthly lending volume was $562.33 million in March 2024.

The other two significant NFT lending platforms are Arcade and NFTfi, with 2.80% and 2.20% of the market share, respectively. They reported a quarterly high lending volume of $39.46 million (37.1% increase QoQ) and 35.88 million (48.3% increase QoQ), respectively.

The other three NFT lending platforms tracked by the report are X2Y2, BendDAO, and Parallel Finance, with their respective market shares of 0.78%, 0.77%, and 0.54%.

Blend which was launched in May 2023 uses a peer-to-peer lending model where borrowers who want to use their NFTS as collateral can find lenders offering the best interest rates. While the loans have fixed interest rates, there are no expiration dates. This allows borrowers to pay at their convenience while offering lenders the right to exit their positions by selling the collateralized NFTs through what is called a Dutch auction.

In February 2024, cryptocurrency investor GMoney secured a $1 million loan using a CryptoPunk as collateral on the NFT lending platform Gondi, making it the world’s largest on-chain NFT loan. GMoney used CryptoPunk #8219 for this six-month loan at a 14% interest rate, making him pay $70,000 in interest during the loan term.