The Cardano (ADA) prices are sliding deeper into a negative trend. This market movement resembles many other assets within the cryptocurrency market. Yet, despite the growing negative sentiment, Cardano’s fundamental network is recording a great surge in executed transactions. These transactions comprise mainly Cardano decentralized finance (DeFi) applications due to the hype arising from two new meme cryptos.

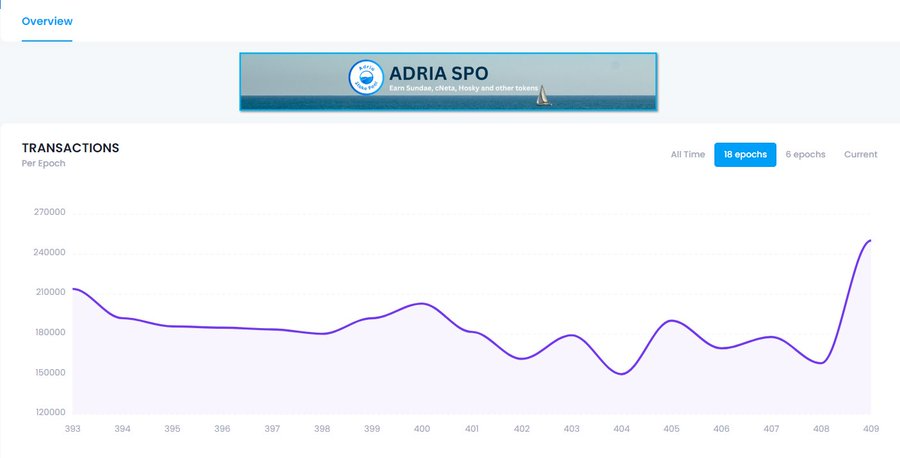

Particularly, the Cardano DeFi applications transactions have increased to reach 250,000 per epoch. It is a notable rise from 160,000 transactions recorded in the previous epoch, based on the chart published on May 8 by the Dapps On Cardano platform. (An epoch on Cardano is currently made up of five days).

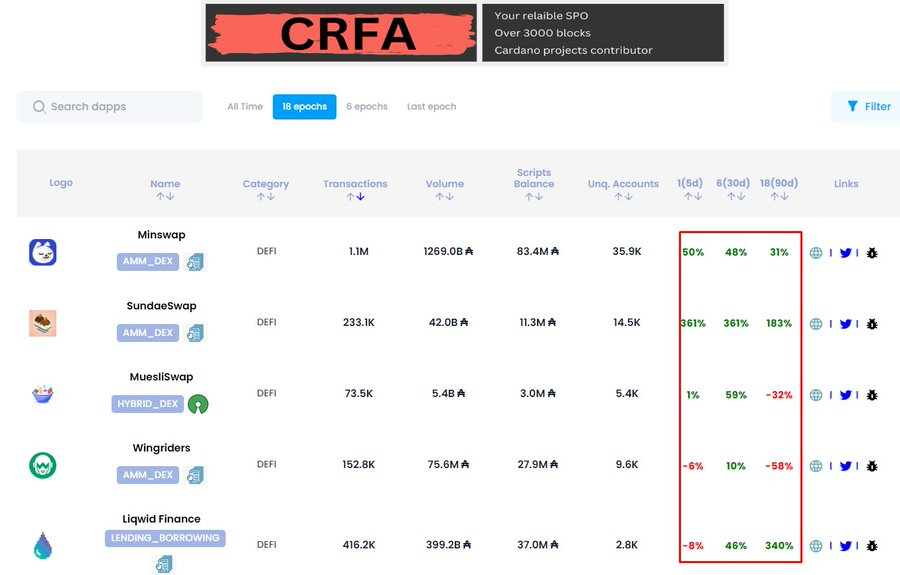

Previously, this dApp tracking website posted another screenshot. That screenshot revealed the results of the best-performing cryptocurrency exchanges and liquidity protocols underpinned by the Cardano blockchain. The protocols include Minswap (MIN), Wingriders (WRT), Sundaeswap (SUNDAE), MuesliSwap (MILK), and Liqwid Finance (LQ). All these platforms have recorded considerable growth in activity in recent weeks.

Meme Coin Hype

Dapps On Cardano platform also published that the growth in the number of transactions such as that was “all thanks to latest meme coins hype like SNEK and PEPE.” Pepeblue is the latest introduction to the Cardano ecosystem and its metaverse. SNEK is based entirely on snake memes that have interior monologue captioning.

Please note, Pepeblue is not directly related to the other trending PEPE meme coin. That coin was designed on April 15 and then published on the Ethereum (ETH) blockchain. It rapidly grew to become the third-biggest meme coin by market capitalization. The exponential growth is attributed to the massive popularity of the Pepe the Frog meme from which it benefited.

ADA Price Analysis

Cardano (ADA) has shed 2% of its value in the last 24 hours. Despite the decline, the crypto might be more bullish than it seems at first glance. An in-depth look at the on-chain data shows an interesting trend: most orders on the market are buys. This could mean that there is an imminent reversal soon, as investors appear to be betting on ADA’s long-term projections.

The latest data shows that buyers are coming in, acquiring ADA at the current market prices. This growing buying pressure might be underpinned by the belief that the digital asset is currently undervalued and is getting ready for considerable upside momentum in the coming weeks and months.

Notably, the trend is emerging amid a widespread market drop. This scenario also underlines the underlying strength of the Cardano fundamentals.

A major factor powering the Cardano bullish sentiment is its steady progress in development and adoption. The increasing interest in Cardano’s NFT and DeFi platforms, together with the current work on scaling solutions like Hydra, also enhances the crypto’s long-term potential.

Another feature that may be luring investors to Cardano is its huge focus on energy efficiency and sustainability. With increasing worries about crypto mining’s environmental impact, ADA’s proof-of-stake (PoS) consensus mechanism provides an eco-friendly alternative to the energy-intensive proof-of-work (PoW) cryptos like Bitcoin.

Cardano’s strong fundamentals coupled with the bullish on-chain data may work as a catalyst for a possible market reversal despite the current dominant bearish trend. Investors need to follow the market dynamics and review all signs of a trend reversal. Some of these signs include a break above crucial resistance levels or elevated trading volume.