KEY POINTS

DraftKings, the American daily fantasy sports and sports betting company, has decided to shut down its non-fungible token (NFT) game Reignmakers and its associated marketplace.

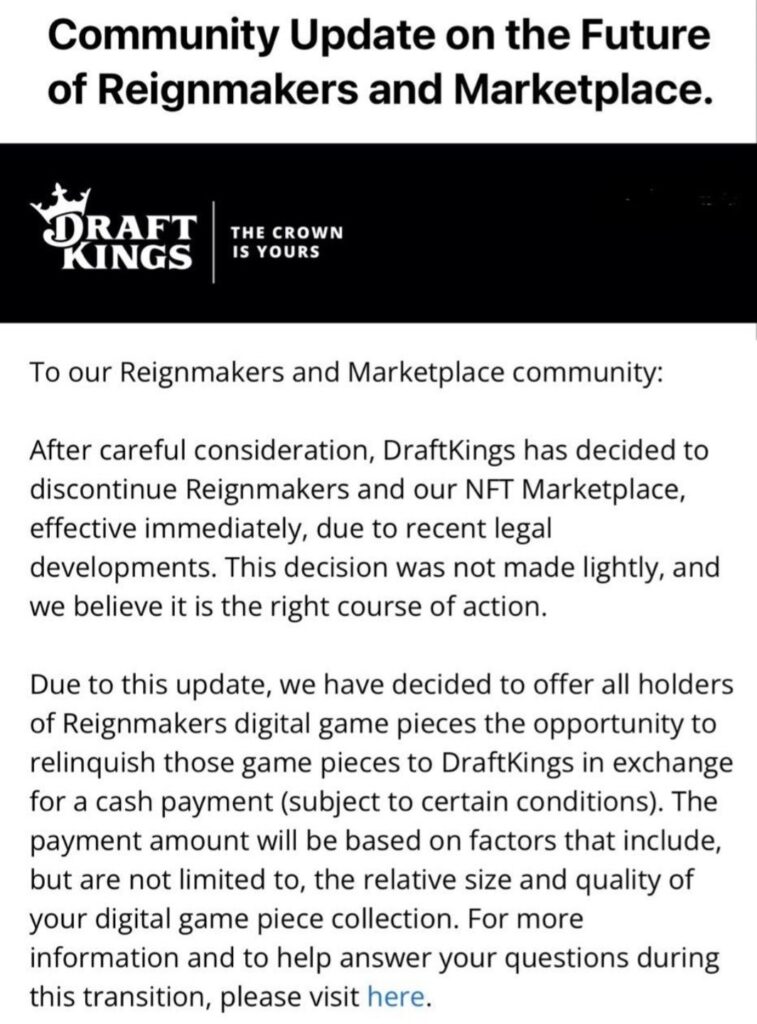

The announcement states, “DraftKings has decided to discontinue Reignmakers and our NFT Marketplace, effective immediately, due to recent legal developments.”

This decision took effect immediately, allowing holders of game pieces to exchange their assets for cash under specific conditions.

This move follows a recent legal setback in which a U.S. judge in Massachusetts denied DraftKings’ motion to dismiss a class action lawsuit filed by buyers of its NFTs. These buyers argue that the NFTs are unregistered securities.

DraftKings ventured into the NFT market in July 2021, after observing a surge in interest among its key customers for digital collectibles like NBA Top Shot. The company had even filed NFT-related trademark applications in late 2022.

However, ongoing legal uncertainties have made it difficult for DraftKings, as well as other major projects in the industry, to continue their operations smoothly.

For instance, Starbucks ended its NFT rewards beta program, Odyssey, in March, and GameStop shut down its NFT marketplace in January after two years of operation.

The main issue causing these shutdowns is the uncertainty over whether NFTs should be considered securities. This uncertainty has led to several legal actions and penalties against NFT projects.

Last August, the Securities and Exchange Commission (SEC) took its first action in an NFT case against Impact Theory, a Los Angeles-based media company. The company was fined $6.1 million for offering unregistered NFT securities known as “Founder’s Keys,” violating securities laws.

In September, the SEC also targeted the Stoner Cats NFT project, resulting in a $1 million penalty for selling unregistered securities. More recently, Dapper Labs settled a lawsuit over its NBA Top Shot NFTs for $4 million.

In response to these regulatory pressures, two artists have filed a lawsuit against the SEC to clarify whether NFTs should be classified as securities. The outcome of this legal challenge could determine whether NFT creators must register their assets and disclose potential risks to buyers, which would significantly impact the market’s future.